PactSafe is transforming the way software-as-a-service companies use contracts

Let’s face it, business-to-business (B2B) contracts are a hassle. Despite their necessity, problems with contracts are the reason about one out of every 10 deals deals falls apart due to inefficiencies, legal reasons or other friction throughout the contracting process. And forget about analytics; accessing contract data is a manual process that makes getting a clear picture of important enterprise trends cumbersome at best.

Eric PrughCofounder & COO

Prugh explained that Indianapolis-based PactSafe has a unique approach to contracting that sets the company apart from other electronic signature solutions during this transitional period in the marketplace. There are products that make it a lot easier to sign and execute contracts and there are products that help to manage those contracts into a kind of repository, but Prugh says most of those products are just shoehorning the old paper and PDF process into a digital environment.

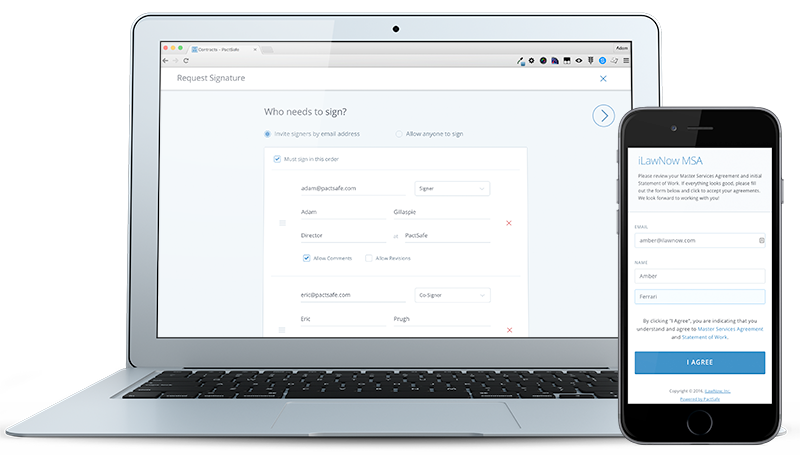

Transact, a new eSignature platform from PactSafe, is a digital native, mobile-first way to send, negotiate, and sign contracts that transforms the process from slow and painful to fast and just as easy as buying something online from Amazon.

PactSafe’s proprietary “click-to-sign” eSignature technology is combined with Transact’s easy-to-use contract automation and management tools to create a contracting solution that’s built for the way people do business online today.

Transact allows for inline and real time collaboration and redlining, preventing typical bottlenecks in the negotiating process. Built-in analytics track who, what, when, where and how each contract is executed in compliance with established eSignature standards and enterprises get access to analytical insight of contract changes over time.

Any business that uses contracts could use PactSafe’s solutions and the company has customers in a variety of industries, but there’s a special focus on software-as-a-service (SaaS) because of the nature of the business itself being digitally native with challenges that PactSafe’s Transact platform directly addresses.

“If your legal counsel or potential investors ask questions about limited liability and other risk exposure or how many customers have net 30 days payment terms, you have to read through every contract and extract that information and manually enter it into a spreadsheet. That’s not exactly efficient and it’s taking you and your team away from the core business and what you’re really good at,” Prugh said. “With Transact and our other solutions, we speed everything about the process up and organize all of that vital information for you automatically so that the answers are at your fingertips.”

Adam GillaspieCofounder & Director of Development

COO Prugh and Director of Development Adam Gillaspie both worked at ExactTarget (now Salesforce) before joining forces with President Brian Powers, a former corporate transactional attorney.

Brian PowersCofounder & CEO

The company got its start with its first product, Vault, a first-of-its-kind “legal API” that allows businesses to easily manage the check-box agreements that are delivered on the web or in mobile apps, and still does solid business in the space. PactSafe sees the most potential for growth, however, in the B2B contracting market where the combination of its Vault and Transact solutions allows PactSafe be a disruptor and make the PactSafe brand synonymous with eSignature. “By serving both use cases, PactSafe becomes the only contracting platform in the world to manage both B2B contracts and the check-box agreements we all read and accept every day,” Prugh said.

PactSafe prides itself on “playing nice with others” and its electronic signature solutions integrate well with other software platforms like fellow Indy-based Formstack — a current customer that has PactSafe solutions fully integrated into its SaaS application.

PactSafe’s target customers are B2B or B2B2C companies (specifically with SaaS and tech firms), but that doesn’t rule out other industries. Prugh quoted his former boss, local Salesforce executive Scott McCorkle, stating “every company is a technology company today,” so every company that uses contracts is a potential customer for PactSafe.

To date, PactSafe has raised $1.2 million in investment and a Series A round is planned for next quarter. According to announcements, the funding will go toward attracting talent in sales and software engineering.

“We are all consumers, we all buy stuff, and 80 percent of people buy stuff online once a month now so there’s this expectation of good service and good experience. B2B and B2C are really converging and B2B e-commerce is emerging as a great way for businesses to buy from other business and and we’re right in the center of that emerging markeplace.”

In an effort to raise the visibility and accelerate the growth of Indiana tech companies, each week we will spotlight a growing company with a compelling story. In particular, we will spotlight scale-up companies that are rapidly emerging and could become our community’s future success stories. Visit this page to learn more the Tailwind program and see if your company qualifies.

The Tailwind program is supported by grants from the Indiana Office of Small Business and Entrepreneurship (OSBE) and the JPMorgan Chase Foundation.